Earning Per Share(EPS) is widely used by investors and other stakeholders to assess the performance of a company. It is also used to calculate the Price/Earning ratio, which is of particular importance to investors. In order to ensure consistency in the calculation of EPS, IAS 33 was published. EPS is the only financial ratio which is regulated by a standard.

What is Earnings

Earnings are profit after tax and preference dividend. In other words, it is the profit attributable to the owners of the company after deducting all expenses.

Basic Earning Per Share

The formula for calculating basic earning per share is given as:

How to calculate weighted average number of shares

If a company has 10,000 shares at the beginning of the year(January 1, 2019) and issues 50,000 shares in July 1, 2019, the weighted average shares for the year ending December 31 2019 is calculated as follows:

Step 1, Determine the number of months the initial number of shares were in issue until the new issue. From the illustration, the 10,000 shares were in issue from January, February, March, April, May, and June, which is 6 months. Divide the result by 12 months and multiply by the shares.

Example 1

On January 1, a company had 5,000,000 ordinary shares in issue. On 1 April, 1,000,000 shares were issued. On 1 July an extra 1,000,000 shares came into existence. On 1 November 500,000 more shares were issued. All issues were at full market price.

Required:

Calculate the weighted average number of shares.

Solution

Types of Share Issues

There are three types of share issues. These are

1. Share issue at full market price

2. Bonus issue

3. Right issue

1. Share issue at full market price: This is where a company issue shares at the prevailing market price of the shares.

2. Bonus issue: Refers to the issue of new shares to existing shareholders, in proportion to their existing shareholding, for no consideration. It means the shareholders do not pay for the new shares.

3. Right issue: This is where a company issues new shares for cash for existing shareholders. However, the shares are priced below the market price. This means that there is a bonus element in right issue.

Calculation of Bonus Issue

The number of bonus shares is calculated by calculating the bonus fraction. The bonus fraction is then multiplied by the number of existing shares in issue.

Example:

ATL Limited had 2,000,000 shares in issue in January 1, 2019. On July 1, 2019, it made a 1 for 4 bonus issue.

Required:

Calculate the bonus fraction

Restatement of Comparative Figures

Whenever bonus shares are issued, the previous year’s EPS should be adjusted as if the bonus shares were in issue that year. The calculation is quite straightforward.

The calculation is as follows:

Multiply the previous year EPS by the inverse of the bonus fraction. Assuming that the previous year EPS was GH¢5 per share. The restated EPS will be:

Calculation of Right Issue

Remember, we said the right issue has a bonus element. This means the bonus fraction should be calculated. In order to calculate the bonus fraction, we need to find the following:

1. Market share price: This is the prevailing market price. Usually given in the question

2. Theoretical ex right price: This is the assumed(theoretical) price of shares after the right issue.

Example

A company had 3,600,000 shares in issue on 1 Jan Year 2. It made a 1 for 4 right issue on 1 June Year 2, at a price of GH¢40 per share. The share price just before the right issue was GH¢50. Total earnings in the financial year to 31 December Year 2 was GH¢25,125,000. The reported EPS in Year 1 was GH¢6.4.

Required:

Calculate EPS for Year 2 and a comparative EPS for Year 1.

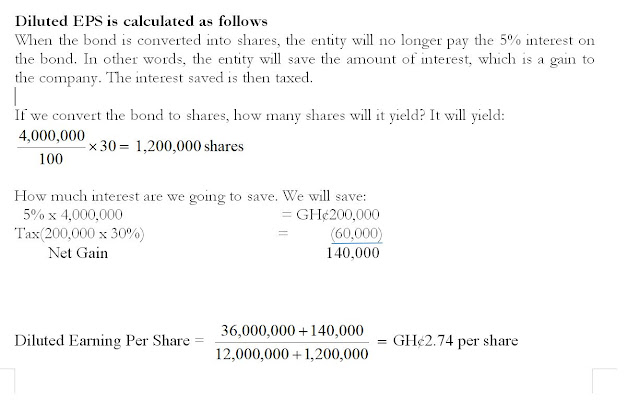

Diluted EPS: Options

Options are contracts issued by an entity which allow the holder of the option to buy shares of the company at some point in the future at a pre-determined price.

Example:

A company has 5,000,000 ordinary shares in issue. Earnings for the year ended 2019 was GH¢25,000,000. There are outstanding share options on 400,000 shares , which can be exercised at a future date, at an exercise price of GH¢25 per share. The average market price of shares in 2019 was GH¢40.

Required:

(a) Calculate the Basic EPS

(b) Calculate the Diluted EPS